Inside a Multi-Million Dollar Investment Portfolio: Strategies, Tax Benefits, and Retirement Planning

This video provides insights into a multi-million dollar investment portfolio, including active and passive strategies, maximizing tax benefits, and retirement planning.

00:00:00 This video provides a high-level overview of a multi-million dollar investment portfolio and the investing process behind it. The presenter shares personal stories and lessons learned to help viewers develop their own investment strategies.

📚 This video provides an overview of the speaker's investment portfolio and process.

💡 The speaker shares personal experiences of overcoming financial challenges and emphasizes the importance of learning from mistakes.

🔧 The speaker introduces 'the machine,' his investment process that focuses on optimizing cash flow and time.

00:02:54 Discover the 12 investments that make up a multi-million dollar portfolio, including active and passive investing strategies and maximizing tax benefits.

📊 Active investing involves dedicating time, energy, and resources, while passive investing is a more hands-off approach.

💰 Structured investing with tax benefits and optimized time leads to self-perpetuating growth.

💼 A diversified portfolio consists of active and passive investments, with a focus on maximizing ROI on active investments.

🌟 The speaker allocates 70% of capital to active investments and 30% to passive investments.

🔑 Passive investments include retirement accounts, long-term taxable stock market accounts, and cash/cash equivalents.

⬆️ The best performing asset for the speaker in the past 10 years is revealed.

00:05:50 This video discusses various investments in a multi-million dollar portfolio, including businesses, crypto trading, angel investing, and stock market trading.

💼 The value of businesses invested and cash reinvestment are important aspects of a successful portfolio.

💰 Crypto trading and investing, angel investing, and stock market trading are key components of a multi-million dollar portfolio.

📈 Long-term position trading, swing trading, and day trading are different strategies used in crypto trading and investing.

🌱 Angel investing allows for investment in startup founders and funds, providing opportunities to work with and support other entrepreneurs.

📊 Active stock market trading using both fundamental and technical analysis can be profitable when approached with the right strategies.

00:08:44 In this video, the speaker discusses their investment portfolio, highlighting their strengths and weaknesses in various areas. They emphasize the importance of partnering with experts and focusing on core competencies. The video also touches on retirement planning and setting up a qualified plan.

💼 Knowing your strengths and weaknesses is crucial in investing. Partnering with experts in areas where you lack skills can be a smart strategy.

💰 Focusing on your core competencies can lead to success. Investing in retirement and tax-efficient options is important, regardless of your goals.

🏡 Real estate fix and flips can be challenging. Partnering with experienced individuals can help minimize losses and maximize returns.

00:11:41 This video discusses different types of investment accounts for business owners and entrepreneurs to build wealth and secure their retirement. It covers pension accounts, solo 401k, self-directed IRAs, stock market accounts, and managed futures accounts.

💰 Setting up and fully funding your own pension as a business owner can save you a significant amount of money.

💼 Investing in tax-efficient retirement accounts such as solo 401k and self-directed IRAs allows for diversified investment opportunities in real estate, stocks, and private equity.

📈 Long-term stock bond portfolios and managed futures accounts are two major investment categories for building wealth passively and outsourcing investment management.

00:14:35 This video discusses the investments in a multi-million dollar portfolio, including cash equivalents, high-yield savings accounts, cold storage crypto, and precious metals as a hedge against inflation.

💰 Having too much cash can result in losing money to inflation, so billionaires tend to hold their wealth in business value or public markets.

💵 A high-yield savings account can help combat inflation by earning interest, while cold storage crypto and precious metals are seen as hedges against inflation.

📈 Crypto has been increasing in value more than the dollar has been eroding, making it a potential investment option for preserving wealth.

00:17:31 A high-level overview of my investment portfolio strategy, focusing on maximizing cash flow, leveraging core competencies, and optimizing tax advantages.

💰 The focus of investing should be on generating high cash flow.

⏰ Invest in areas where you have core competencies and can achieve the highest return on investment of your time.

🏦 Take advantage of tax benefits and deductions to optimize passive investments.

You might also like...

Read more on Howto & Style

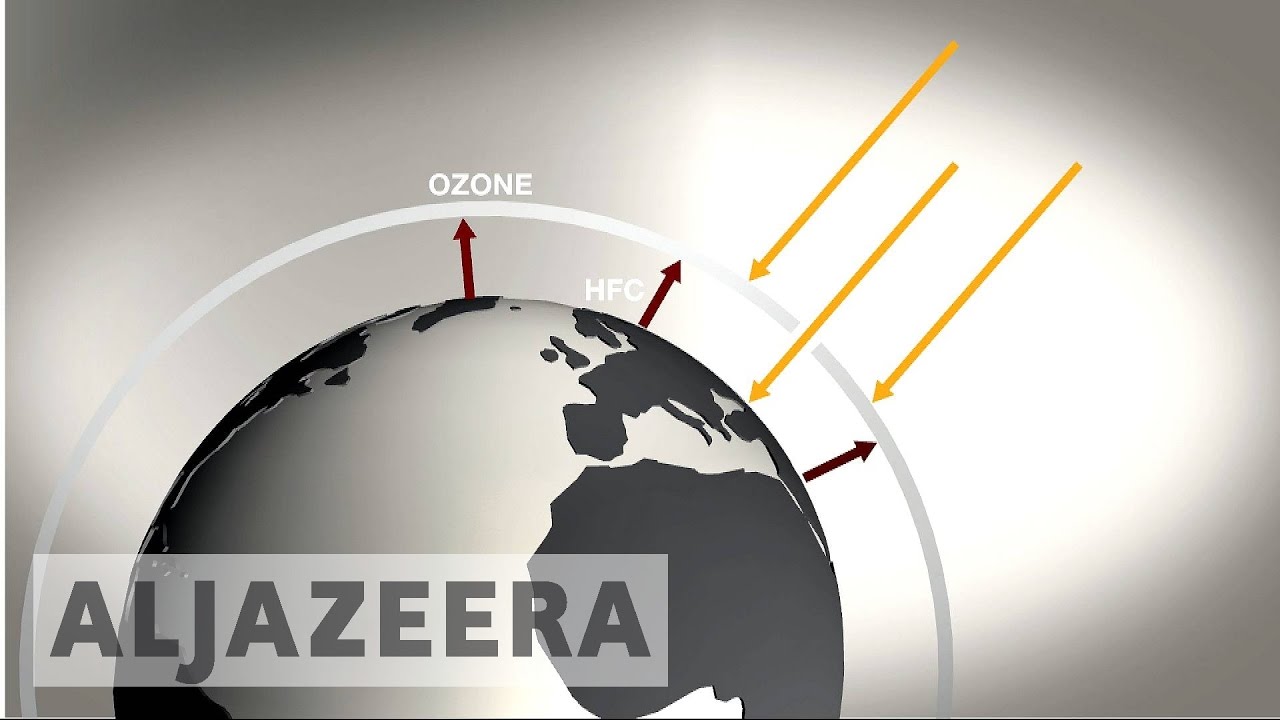

Landmark deal reached on greenhouse HFC gases

Z Fellows Startup Workshop: "Lessons to My Younger Self" with Adam Guild

Climate change: what is ocean acidification?

201 - Deep dive back into Zone 2 Training | Iñigo San-Millán, Ph.D. & Peter Attia, M.D.

1. Napoleone: la campagna d'Italia, la missione in Egitto e il colpo di stato del brumaio 1799

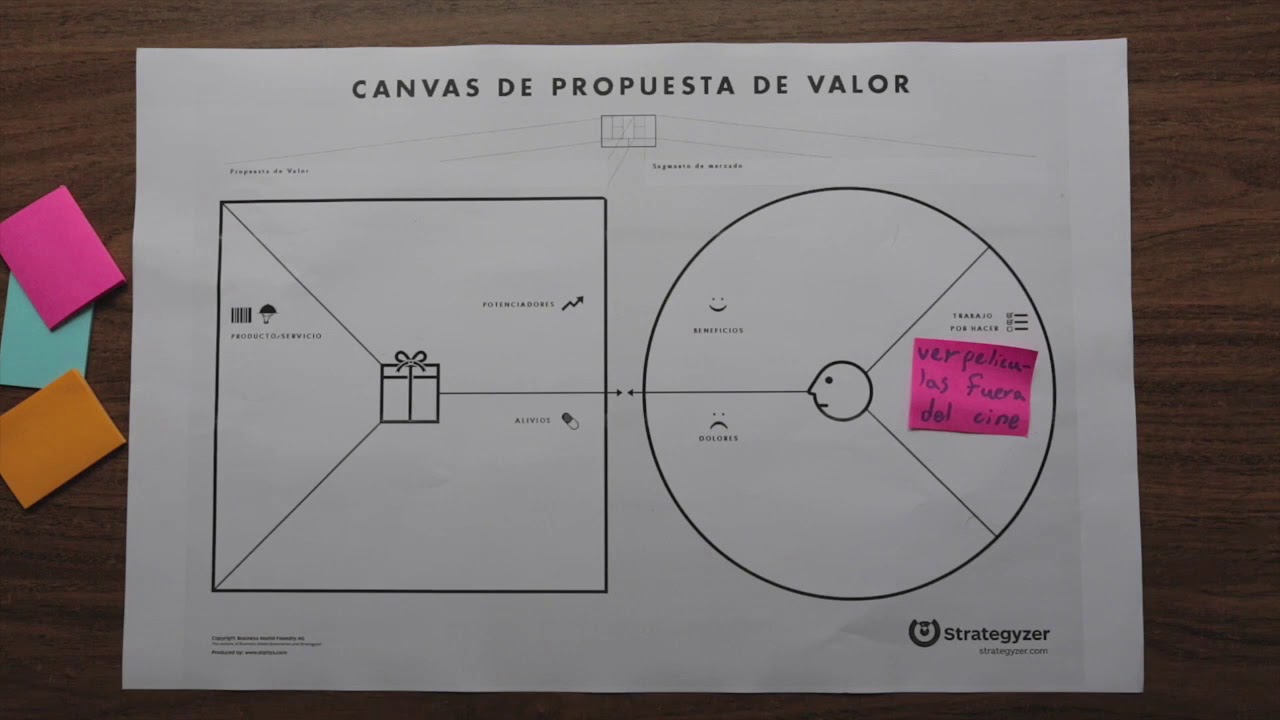

Canvas Propuesta de valor