Analyzing Bitcoin's Monthly Levels and Outlook

Bitcoin's monthly levels are in a critical position after months of trading between support and resistance. The monthly outlook is weak, but a rally above 30k or a drop to discounted support levels could shift it to the bullish side.

00:00:01 Bitcoin's monthly close signals a breakdown, with support levels at around 24K. Check out the execution dashboard on Wu for trading insights.

📊 The video highlights the importance of the execution dashboard on the website, which allows users to compare different assets and determine the cost of trading on various venues.

💰 The monthly close for BTC indicates a breakdown as it failed to hold the local range low, with the next levels of monthly support around 24K.

💻 The video emphasizes the significance of execution and trading costs for those who are serious about their trading, providing insights into favorable fee methodologies and comparisons between different exchanges.

00:01:30 Bitcoin's monthly levels are in a critical position after months of trading between support and resistance. Testing support is now more likely as the price action has broken down. The monthly outlook is weak, but a rally above 30k or a drop to discounted support levels could shift it to the bullish side.

📊 Bitcoin has been trading between the levels of 34-35 and 39 for the past 5-6 months, but now it seems like testing support is more likely than testing resistance.

📉 The monthly timeframe of Bitcoin looks weak and not strong. To shift to the bullish side, the options are to close above 30k or dump into discounted levels of support.

💼 The news of a legal victory for the spot ETF was overshadowed by the delay in the BlackRock ETF and other similar ones, resulting in weak market impact.

00:03:16 Bitcoin monthly levels show weak news priced in, sellers control market rally. 26k support may continue to be shallow unless something changes. Next tradable levels are at 23.3k and 21k.

📉 Sellers are currently dominating the market despite buyers having good reasons to buy.

📊 The 26k support level has been effective, but its impact may be limited in driving significant bounces unless something changes.

⚖️ The monthly and weekly levels at 23.3 and 24.3 respectively are important areas to watch, with 21k as the next level if the current range breaks.

00:05:01 Bitcoin remains volatile with low volume, retracing any gains and staying in a bearish territory. Daily levels at 26k and 26.4k are key anchors to watch, but overall the market outlook is not optimistic.

📉 The volatility index is still drifting lower, indicating low volatility in the market.

📉 Price action has been retracing and sellers seem to be in control, with any green days being fully retraced the next day.

🔍 The daily view suggests potential bearish retest territory around the 26k range, with no compelling technical view.

00:06:46 Bitcoin is showing signs of weakness and is struggling to find support. The best argument would be to wait for a failed breakdown reclaim at 1700, but overall it is not a great time for Bitcoin.

Monthly time frame rotation to monthly support is interesting.

Weekly failed breakdown through weekly lows is notable.

BTC is struggling to find support and may continue to decline.

00:08:33 This video discusses the relationship between the stock market and cryptocurrency. It also mentions the lack of trading opportunities for altcoins.

💡 The correlation between the S&P and crypto markets has been unfavorable for a long time.

💭 For now, the speaker is not spending much time thinking about the S&P as it is not helpful.

📉 Trading altcoins is not favorable due to flat price changes and lack of market conditions.

00:10:17 Bitcoin monthly levels stabilize after 6 months, but caution is advised for low conviction trading. Educational content available. Thank you to the channel supporter. Have a great week!

📉 Bitcoin's on-chain activity has decreased in the short to medium term.

💰 Waiting and not actively trading Bitcoin may not result in significant missed opportunities.

📚 The speaker has been posting educational content on Twitter and welcomes suggestions for future topics.

You might also like...

Read more on Entertainment

Por los sueños se suspira, por las metas se trabaja. | Humberto Ramos | TEDxCuauhtémoc

Mettaliderazgo, creando líderes de alto desempeño | Roberto Mourey | TEDxBarriodelEncino

Welcome to my Beijing tiny house!

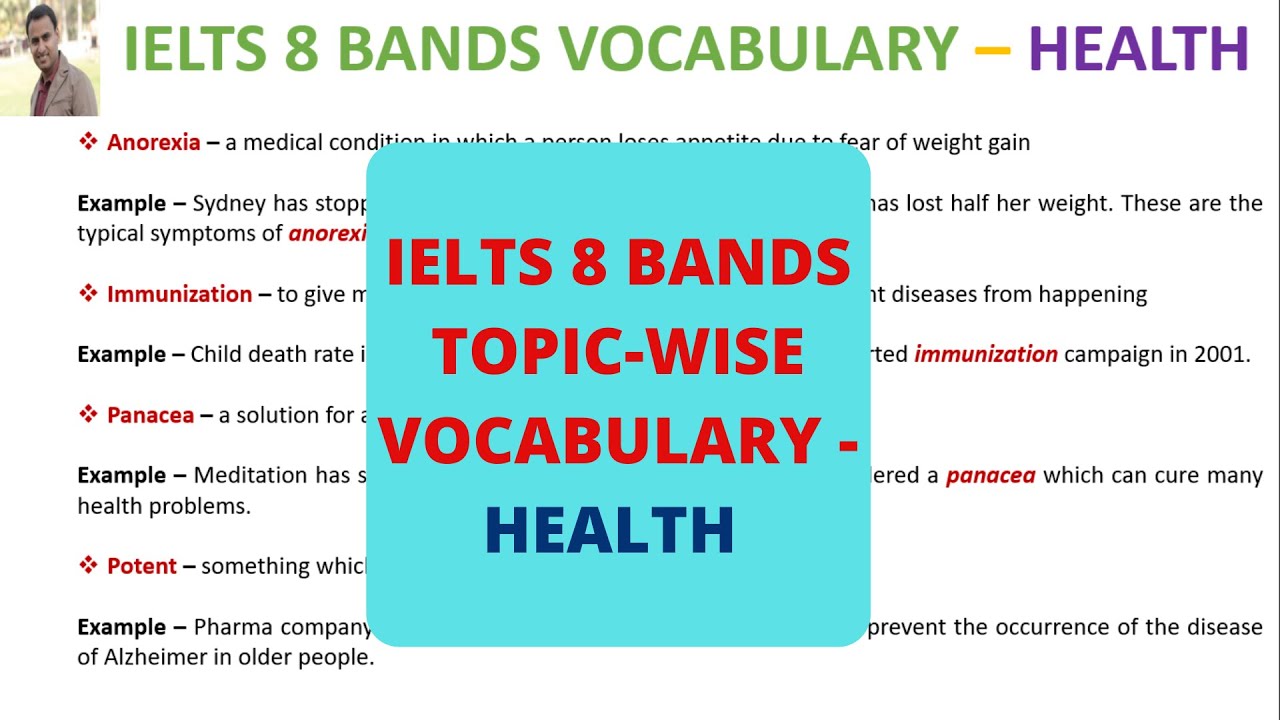

IELTS 8 BANDS VOCABULARY HEALTH

HOW TO: Straighten 4C Natural Hair Tutorial (No Blow Dryer Needed)

#2 Eclipse & Tomcat Server Install full setup | Advance Java Servlet & JSP Full Tutorial