Developing the Right Mindset and Risk Management in Trading

Episode 24 of the 2022 ICT Mentorship emphasizes the importance of mindset and risk management in trading, encouraging active engagement and independent thinking.

00:00:05 Episode 24 of the 2022 ICT Mentorship on YouTube emphasizes the importance of having the right mindset and being responsible and attentive in learning. Viewers are encouraged to actively engage with the content and apply it to their own trading journey.

📺 This video is episode 24 of the free ICT mentorship series on YouTube for 2022.

🔒 The mentor emphasizes the importance of having the proper mindset and being sincere about learning.

📈 The mentor encourages students to actively interact with the content, study the patterns, and apply them in their own trading.

00:06:07 2022 ICT Mentorship Episode 24: Emphasizes the importance of mindset and risk management in trading, discourages relying solely on watching videos, and warns against blindly following trade ideas.

💡 The speaker discusses a specific trading strategy involving a drop at 9:30 and a run into a certain level.

🧠 The video emphasizes the importance of mindset, critical thinking, and risk management in trading success.

⚠️ The speaker explains why they don't do live trading sessions and highlights the lack of responsibility among traders.

00:12:09 In Episode 24 of the ICT Mentorship, the speaker emphasizes that all teachings are for demo and paper trading, not for making real money. They also warn against impatience and urge viewers to avoid making trades without proper preparation.

🔑 All trading advice given in the video is for demo and paper trading purposes only, not for live funds.

💡 The speaker emphasizes the importance of understanding the content and process before trading with live funds.

🚫 Disruptive and disrespectful comments will be removed, but respectful disagreement is allowed.

00:18:11 In this video, the speaker discusses the logic behind a trading model and the importance of critical thinking. They also analyze the market and explain the patterns and catalysts for potential trade setups. The speaker emphasizes the need to follow their teachings and not impulsively trade.

📈 The speaker discusses a model and asks for critical thinking from the audience.

🌍 The audience is asked to share their location for a broad range view of viewership.

⬆️ The speaker explains the logic of a possible drop in the market based on patterns and catalysts.

⏰ The speaker discusses the importance of time and volatility in trading.

📉 The speaker explains a trading strategy involving displacement and fair value gaps.

❌ The speaker warns against impulsive trading and taking guesses.

00:24:13 Learn the responsibility and self-control needed to succeed in trading. Follow the rules and develop your own logic. Take ownership of your results.

💼 The responsibility for success in trading lies solely with the viewer, not the mentor.

📚 Successful trading requires diligent study, self-control, and adherence to rules.

🔒 If rules are not followed, impulsive actions can lead to financial ruin.

00:30:17 The video discusses the importance of managing losing trades and finding fair value setups in trading. It emphasizes the need to endure losses and explains the logic and pattern of identifying trigger points for high probability trades.

Trading is all about managing losing trades and enduring them.

Setups form when price runs above relative equal highs and then breaks back down below them.

The foundation of a setup is the displacement leg and price action that follows breaking the short term low.

00:36:18 Learn entry strategies and market structure analysis in this episode. Don't dwell on missed opportunities, focus on conditioning yourself to handle setbacks.

📈 There are two entry strategies for this model: trading above the low of the fair value gap or waiting for a trigger that indicates a shift in market structure.

📊 The trading logic discussed in the video is algorithmic and repeatable, demonstrated through price action in live data and old backtesting.

❌ Although the expected setup did not occur in the market, the absence of a winning trade does not mean the model is broken or that trading opportunities cannot be found.

You might also like...

Read more on Education

Caleb Karuga ; How to become a rich farmer in Kenya

À quoi ça sert de dormir ? - 1 jour, 1 question

Taiko em oi hockey estádio: impressionante!

Why do we have different alcohol tolerances?

Inspirational Video- Be a Mr. Jensen- MUST WATCH!!

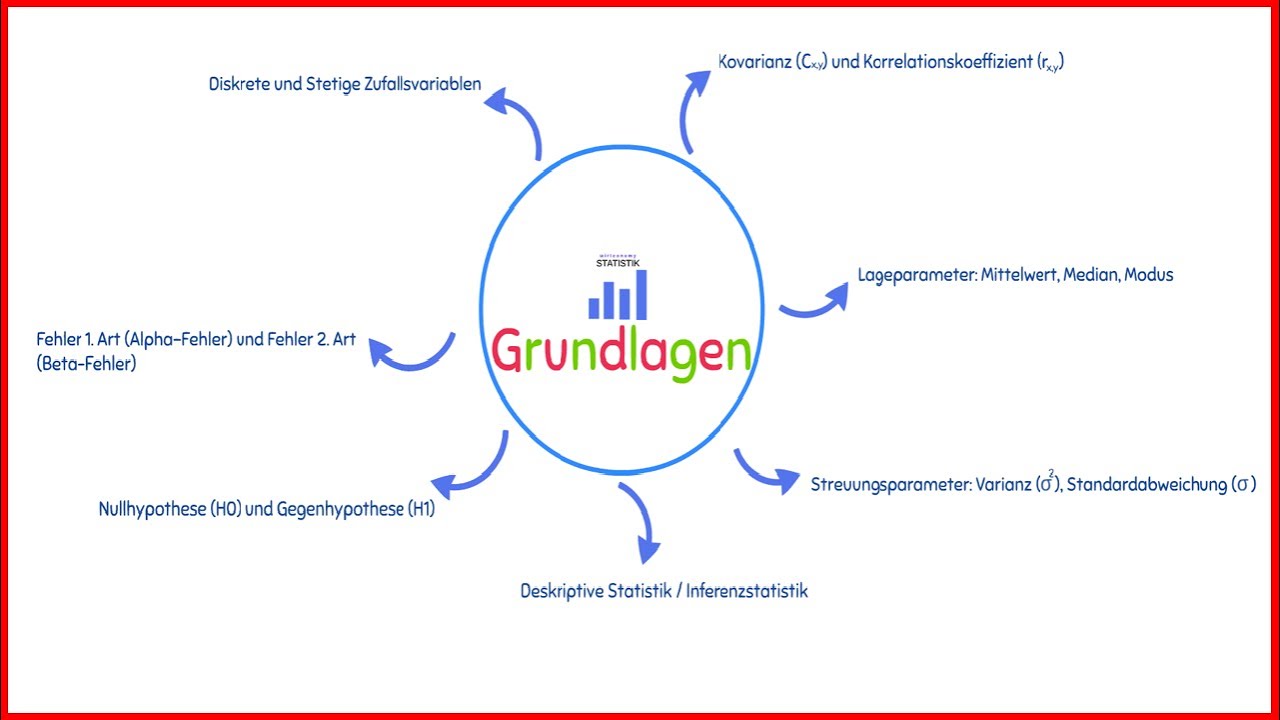

Statistik Grundlagen | Die wichtigsten Themen für deine Klausur 📔✏️ | Übersicht | wirtconomy