Understanding the FOMC Decision and Press Conference: Key Points and Challenges

Recap of the FOMC decision for Sept 20, 2023. Federal funds rate projections have decreased, suggesting fewer rate cuts in 2024. Real GDP and unemployment rate projections have improved. Inflation is expected to decrease slightly. Questions arise about the possibility of higher interest rates.

00:00:00 Summary: Recap of the FOMC decision for Sept 20, 2023. Federal funds rate projections have decreased, suggesting fewer rate cuts in 2024. Real GDP and unemployment rate projections have improved. Inflation is expected to decrease slightly. Questions arise about the possibility of higher interest rates.

The FOMC has revised its projection for the federal funds rate, indicating a decrease in the number of rate cuts for 2024.

The projections for Real GDP show an increase in growth for 2024 but a return to trend for 2025 and 2026.

Unemployment rate projections show a slight decrease in 2024 compared to the previous projection.

00:04:56 The FOMC decision and presser recap for September 20, 2023 discussed the Dot Plot and economic projections. There was uncertainty in the Dot Plot with 12 out of 19 members suggesting a rate hike. The committee believes rates are not sufficiently restrictive yet and are cautiously monitoring economic activity.

📊 The Dot Plot in the summary of economic projections shows widening uncertainty in the near term and convergence in the long term.

📈 12 out of 19 dots suggest one rate hike in 2023, while 7 out of 19 suggest no rate changes.

💼 The Fed is in a position to move carefully and does not expect significant macroeconomic impact from one rate hike.

00:09:53 Summary: FOMC decision and presser re-cap discussing inflation projections, higher rates in 2024, neutral rate, soft landing, and nominal rates. No rate cuts discussed. Answering questions cautiously and emphasizing the need for data-driven confidence.

📈 The inflation projection remains the same, but there is a need for higher rates in 2024 due to stronger economic activity.

💼 The concept of the neutral rate is discussed, with uncertainty about whether it has risen and a statement that it will only be known when observed.

💰 Reducing inflation may have a lower cost in terms of economic slowdown, but there still needs to be some softening in the labor market.

00:14:47 Summary: FOMC discussed strong economic activity driven by consumer demand, not mandate GDP growth. They emphasized the importance of addressing rising oil prices and labor strikes. Sustained high energy prices could impact inflation. Soft landing is a primary objective. Focus is on carefully restoring price stability.

💡 The speaker discusses the possibility of future rate cuts.

📈 Strong economic activity is being driven by consumer demand.

⚖️ GDP is not their mandate, but full employment is.

💼 Rising oil prices and labor strikes are potential concerns.

📉 The speaker mentions the decreasing share of income going to labor.

🔍 Uncertainty surrounds the impact of these factors on the economy.

💰 Sustained high energy prices could pose inflationary risks.

🏢 The objective is to achieve a soft landing in the economy.

🔒 Restoring price stability is a primary objective.

📈 The speaker acknowledges the importance of carefully managing interest rate hikes.

📉 Disinflation has been seen so far, but inflation needs to be brought back.

00:19:42 Summary: The FOMC decision and press conference for September 20, 2023 discussed the need to unwind previous year's stimulus and bring supply and demand into balance. Forecasts were deemed unreliable, and the surprising progress in the labor market without higher unemployment was highlighted. The potential government shutdown and rising energy were also mentioned. Overall, economic forecasting is challenging. Alternative Title: Understanding the FOMC Decision and Press Conference: Key Points and Challenges

📋 The FOMC decision and press conference for Sept 20, 2023, discussed unwinding previous year's stimulus and balancing supply and demand.

🎯 Forecasts by the committee are unreliable and difficult to make, and they have no more information or knowledge than the public.

💪 Despite higher-than-anticipated growth and progress in the labor market without higher unemployment, economic forecasting remains highly uncertain.

00:24:37 Summary: Examining credit card debt levels in relation to disposable incomes and consumer stress indicators. Discussing the impact of inflation on yields and the role of housing supply in taming inflation.

Disposable incomes and credit card balances have increased due to higher incomes and more people having credit cards.

Looking at the level of debt alone is misleading, as it should be considered in relation to other factors like equity and consumer stress indicators.

Rising market yields are attributed to factors like growth, real yields, term premium, and treasury supply, not necessarily inflation.

Taming inflation is influenced by the shortage of housing supply, particularly in relation to immigration and the lock-in effect of low mortgage rates.

00:29:30 Summary: Recap of the FOMC decision and press conference for Sept 20, 2023. Discussion on the housing market, interest rate sensitivity, and job market strength. Alternative Title: Key Takeaways from the Sept 20, 2023 FOMC Decision and Presser.

💡 Supply constraints in the housing market are keeping house prices elevated, but the Federal Reserve is not concerned and will continue with its policies.

📉 Rents are being reset at lower increases than last year, indicating a decrease in consumer spending.

🏦 There seems to be a division in interest rate sensitivity, with some people unaffected by rate hikes while others feel the impact.

You might also like...

Read more on Education

Social media isn't bad: you're just using it wrong | Eva Amin | TEDxCherryCreekWomen

Virtually Founder Video

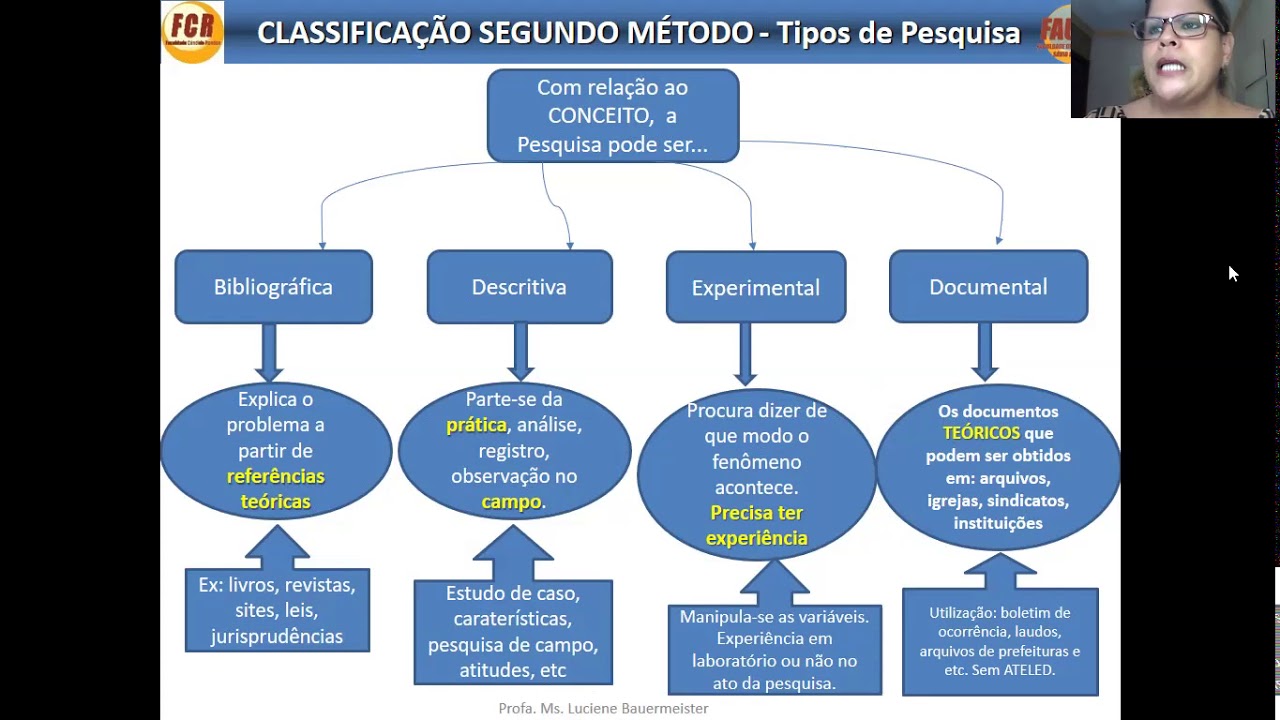

CONCEITO DE MÉTODO E TÉCNICA DE PESQUISA

MONOGRAFIS É A MANEIRA MAIS FACIL DE FAZER SEU TCC A TEMPO

MagicBell's YC W21 application video

Intro to Punctuation for Kids: English Grammar for Children - FreeSchool