Introduction to Forex Margin Trading and Leveraged Trading Commodities

Learn about leveraged trading commodities and forex margin trading. Discover the products offered by an experienced trading platform and get expert insights.

00:00:00 Learn about leveraged trading commodities and forex margin trading. Discover the products offered by an experienced trading platform and get expert insights.

This video is the final episode of a series on leveraged trading commodities and introduces the MT4 and MT5 platforms.

The speaker discusses the range of trading commodities available in Taiwan, including foreign currency margin, precious metals, foreign indices, and US stock CFDs.

The speaker highlights the benefits of trading the Nikkei index, such as low initial margin requirements and reduced risk exposure.

00:06:28 Introduction to Forex Margin Trading: Differences in CFD Commodities and Hedging, Forced Liquidation, and Margin Ratios

The video discusses the concept of margin trading in forex and CFD commodities.

The video highlights the advantages of trading the Nikkei index in CFD.

The video explains the fees associated with trading foreign indices and stocks in CFD.

00:12:57 Learn about the differences between CFD commodities and copy trading in this video. Find out how leverage and overnight interest are calculated.

📈 In forex margin trading, the value of each point is determined by multiplying the index by one US dollar, but this can vary depending on the contract specifications.

🧨 Understanding the contract specifications and the differences in trading methods is crucial when transitioning from forex margin trading to trading in individual stocks.

💼 When trading US stocks through CFDs, it's important to be aware of the leverage ratio and the margin requirements set by the regulatory authority.

💰 While forex positions can be quickly rolled into available margin, positions in CFDs can take up to three days to settle, which affects the speed of fund utilization.

⚖️ The choice between forex margin trading and CFD trading depends on factors such as long-term investment goals, holding period, and the need for leverage.

💡 CFDs are derivative financial products that do not grant ownership rights, but their flexibility lies in leverage, ability to trade in both directions, and real-time settlements.

🌙 Overnight interest charges for index CFDs and stock CFDs can be found on the trading platform as they are subject to fluctuations and adjustments.

00:19:33 An introduction to leveraged trading and the difference in swap fees between stock indices and low-priced stocks in the forex market.

💡 In leveraged trading, low-priced stocks can cause higher swap fees, while higher-priced stocks like Ford may be more suitable for short-term gains.

💰 Fees in leveraged trading form from the leverage itself and upfront charges.

📈 Oil trading can have high swap fees due to the contract size and interest rates, so caution is needed, especially for small contract sizes.

00:26:07 An introduction to forex margin trading for beginners, covering topics such as leverage, margin ratios, and forced liquidation. #forex #margin

There are different levels of funding needed for trading in different markets.

Simulated accounts have automatic position liquidation, but no financial consequences.

Maintaining a certain equity-to-margin ratio is crucial to avoid forced liquidation.

00:32:34 A video about forex margin trading, discussing available margin, maintenance margin, and forced liquidation. The speaker explains how the maintenance margin is calculated and when a brokerage firm will issue notifications and initiate forced liquidation. It is emphasized that maintaining a high maintenance margin minimizes the risk of forced liquidation. Differences in regulations regarding overloss and the importance of trading with regulated brokers are also highlighted.

📊 The video explains the concept of margin maintenance rate and its calculation.

⚖️ Different brokers have varying policies regarding margin notifications and forced liquidation.

💡 Investors are advised to choose regulated brokers to ensure the safety of their funds.

00:39:02 An introduction to forex margin trading, covering CFDs, leverage, and trading costs. Emphasizes the importance of understanding international brokers and regulations to prevent loss of funds.

📈 Focus on your trading to make money in the market.

💰 Trading costs for leveraged trading in Taiwan are higher compared to overseas.

⚠️ Prevention is more important than trying to fix the problem afterward.

You might also like...

Read more on Science & Technology

Lecture 11 – Semantic Parsing | Stanford CS224U: Natural Language Understanding | Spring 2019

Napoleon Bonaparte: Crash Course European History #22

How To Install CODE LLaMA LOCALLY (TextGen WebUI)

Plato’s Allegory of the Cave - Alex Gendler

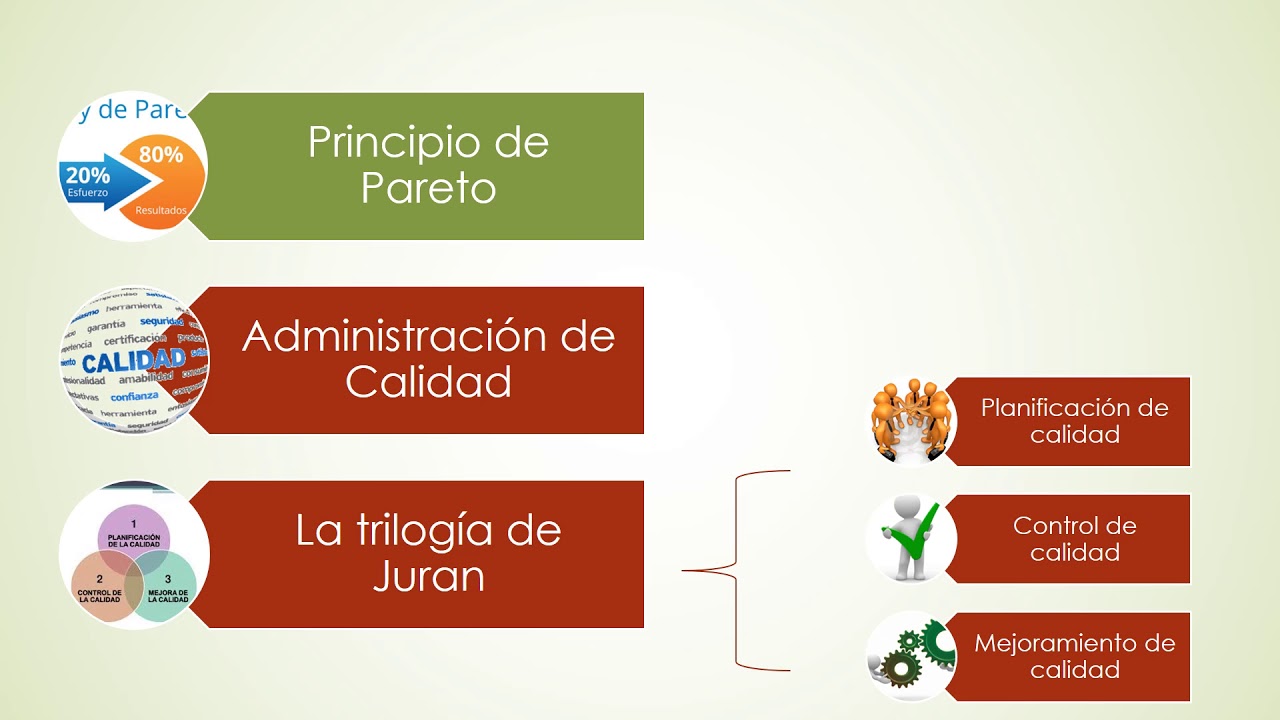

Joseph Juran Filosofía de la calidad

Xiaomi Wowstick electric screwdriver - a few months later review