US Federal Reserve's Balance Sheet Reduction: Implications for Global Economy

US Federal Reserve's significant reduction in its balance sheet raises concerns about global asset prices and impacts the labor market.

00:00:22 US Federal Reserve's significant reduction in its balance sheet raises concerns about the global asset prices, potentially impacting the labor market.

📊 The US Federal Reserve has been reducing its balance sheet, causing a global asset price turmoil.

📉 The latest balance sheet shows a significant decline in US Treasury prices, reaching a new low of $8 trillion.

⬇️ The Federal Reserve is actively reducing its holdings by $600 billion of Treasury securities and $350 billion of mortgage-backed securities per month.

00:04:38 The Federal Reserve's asset balance sheet has fallen below 8 trillion due to disruptions from mortgage-backed securities and the selling of long-term treasuries. The pressure on bond prices and yields is significant.

⭐️ The Federal Reserve's balance sheet has fallen below 8 trillion due to factors like the expiration of mortgage-backed securities and the disruption caused by bank runs.

💸 The Fed is expected to continue reducing its balance sheet by more than 1 trillion per month, leading to a potential normalization of this practice.

📈 The Fed's significant selling of long-term treasury bonds has prompted a decline in bond prices and yields, creating pressure on the bond market.

00:08:52 US consumer stocks, including Buffett's core holding Coca-Cola, saw a sharp decline. The Fed's asset balance sheet may decrease by $3 trillion, including selling half of the US Treasury bonds and mortgage-backed securities (MBS). The liquidity tension in US commercial banks is easing, but the debt side is still a concern.

💥 Heavyweight consumer stocks like Coca-Cola experienced a significant decline in stock prices, signaling an end to the bull market.

💰 The reduction of US Treasury bonds from $7.9 trillion to below $5 trillion and the potential further sell-off of bonds and mortgage-backed securities may impact the real estate market.

💼 The liquidity panic and funding tightness led to commercial banks borrowing from the Federal Reserve, creating a change in the Fed's asset and commercial bank's liability relationship.

00:13:06 The recent decrease in the Federal Reserve's balance sheet may cause a decrease in excess market liquidity and an increase in interest rates.

🔑 The amount of repos has reached an unexpected high of 2.67 trillion, which is a result of the high return rate and low risk of central bank issued credit.

💰 The conservative estimate is that the repos will decrease to around $50 billion, indicating a potential decrease in excess market liquidity.

📈 The recent changes in rates, particularly the increase in US Treasury bonds from 5.3% to 5.45%, have led to a shift in funds from repos to treasury bonds and other securities.

00:17:21 The video discusses the recent decrease in the balance sheet of the US Federal Reserve and the potential impact on the global economy.

The US Federal Reserve has a large amount of excess funds due to the abundance of liquidity, but it has no place to lend or invest, leading to an increase in its assets and liabilities.

The US economy is preparing for a hard landing, which will have a significant impact on the global economy.

A notable investor believes that the US dollar's appreciation trend will end, and US government bonds are nearing the end of their strength.

00:21:32 US debt plunges, Fed sells off assets, balance sheet drops below 8 trillion. Is the US economy in trouble?

📊 The recent actions of the Federal Reserve and the contraction of the balance sheet are causing a significant tightening of monetary policy in the United States.

💰 There is a disconnect between the liquidity in the market and the prices of stocks, suggesting a potential bubble in the stock market.

🔁 The inversion of the yield curve and the transfer of global wealth to the United States through the issuance of the dollar are part of a larger conspiracy to exploit other countries financially.

00:25:45 US Federal Reserve's massive selling of assets has caused the balance sheet to drop by eight trillion, creating fear among Americans due to higher interest rates. Taiwan's stock market is impacted as foreign investors sell.

💡 The US financial condition is tightening, causing concern about high interest rates and how to deal with them.

💰 Taiwan's stock market is experiencing a bubble, with foreign investors selling heavily.

📈 The IMF's classification of developed and developing countries is based on intelligence levels, and the US is considered lower intelligence.

You might also like...

Read more on Education

Arquitectas. Maestras del espacio: Carmen Córdova (capítulo completo)

1 Qué es y como se ve la nube

Crypto CEO Accidentally Describes Ponzi Scheme

SBF Is Going to Jail For A Long Time

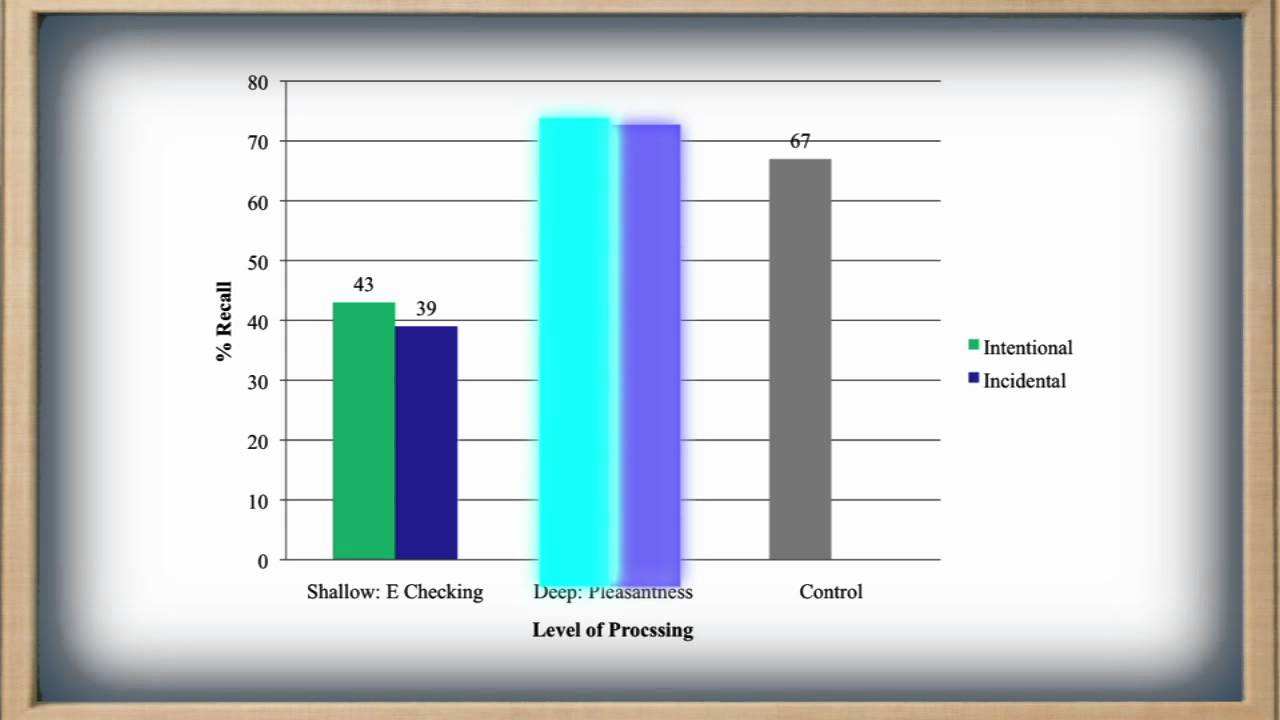

How to Get the Most Out of Studying: Part 2 of 5, "What Students Should Know About How People Learn"

《美政府又要關門?CNN諷"還在打瞌睡!" 美銀:代價恐史上最慘?》【錢線百分百】20230921-7│非凡財經新聞│