Demystifying Bitcoin: The Future of Money

Demystifying Bitcoin: Understanding the digital currency revolution and its impact on the global monetary system and personal finances.

00:00:00 In this video, Dr. Deborah Eckstrom interviews Brad Constanzo about his background in finance and investing. They discuss his experiences with the stock market, real estate investing, and his current interest in alternative investments like crypto and Bitcoin.

📚 Brad Constanzo, an investor and consultant, shares his journey in finance and investing, from his childhood interest in the stock market to his experiences with both success and failure.

💰 He discusses his early fascination with compound interest and his dreams of working on Wall Street, as well as the lessons he learned from his gambling in the stock market and real estate investing.

📈 Brad also talks about his cautious approach during the 2008 financial crisis and his interest in alternative investments, including crypto and Bitcoin, as he continues to learn and make his money work for him.

00:09:24 Demystifying Bitcoin: Understanding the digital currency revolution and its impact on the global monetary system and personal finances.

Bitcoin is a digital currency that is unique and combines various features of other assets.

Bitcoin was developed as a response to the flaws in the global financial system and the lack of trust in traditional currencies.

Bitcoin offers an alternative to traditional saving methods and has the potential to revolutionize the monetary system.

00:18:47 Demystifying Bitcoin: Exploring the properties of money, the value of gold, and the rise of Bitcoin as a decentralized digital currency.

💰 Money should be a store of value, a unit of measurement, and hard to counterfeit.

🔒 Money should be secure and easily transactable.

💎 Money should be scarce and decentralized.

🌐 Bitcoin is a digital ledger that is open source and decentralized.

00:28:10 Demystifying Bitcoin: A secure, uncensorable, and finite cryptocurrency with a global monetary revolution and potential for high returns.

🔍 Bitcoin operates on a secure ledger that cannot be breached or hacked, making it the most secure computer network in the world.

💰 Miners solve mathematical problems on the Bitcoin network to earn Bitcoin, which has a limited supply of 21 million and becomes more valuable over time.

📈 Bitcoin has experienced significant growth and volatility, but each cycle sees it reaching higher levels and gaining more attention as an alternative form of wealth.

00:37:34 Demystifying Bitcoin: Exploring the potential to opt out of the global financial system, protect assets, and potentially make money with Bitcoin. No credible threat to hacking the network, but future quantum computing threat is uncertain.

💰 Bitcoin can be a profitable investment, with the potential to recover losses and make significant gains.

🌍 Bitcoin offers a way to opt out of the existing financial system, protecting assets, privacy, and purchasing power.

🔒 Bitcoin is a secure and independent form of currency that is not vulnerable to hacking or control.

00:46:57 Government can't stop Bitcoin, only manipulate demand and harm price. Owning Bitcoin is a defense against government control. Purchase safely by setting up a Coinbase account and transferring coins to a personal wallet for security.

💡 Governments cannot stop the Bitcoin network or prevent people from transacting with Bitcoin, but they can manipulate the demand and price of it.

🔑 Owning Bitcoin becomes more important if governments and financial powers try to harm the network, as it indicates a strong use case for Bitcoin.

💰 To purchase Bitcoin safely, one can use platforms like Coinbase, but it is recommended to move the coins to a personal wallet for added security.

00:56:22 Demystifying Bitcoin: Exploring its energy consumption and environmental impact, while also highlighting its potential as a global currency and tool for renewable energy.

💡 Bitcoin's proof of work mechanism makes it energy-intensive and generates a large carbon footprint.

🌿 However, 66% of Bitcoin's energy consumption comes from renewable sources, making it one of the greenest technologies available.

💰 Bitcoin mining rigs can be connected to renewable energy sources, providing a market for the excess energy and promoting the use of renewable resources.

You might also like...

Read more on People & Blogs

Cassatt, In the Loge

Electronic Health Records: Past, Present, and Future

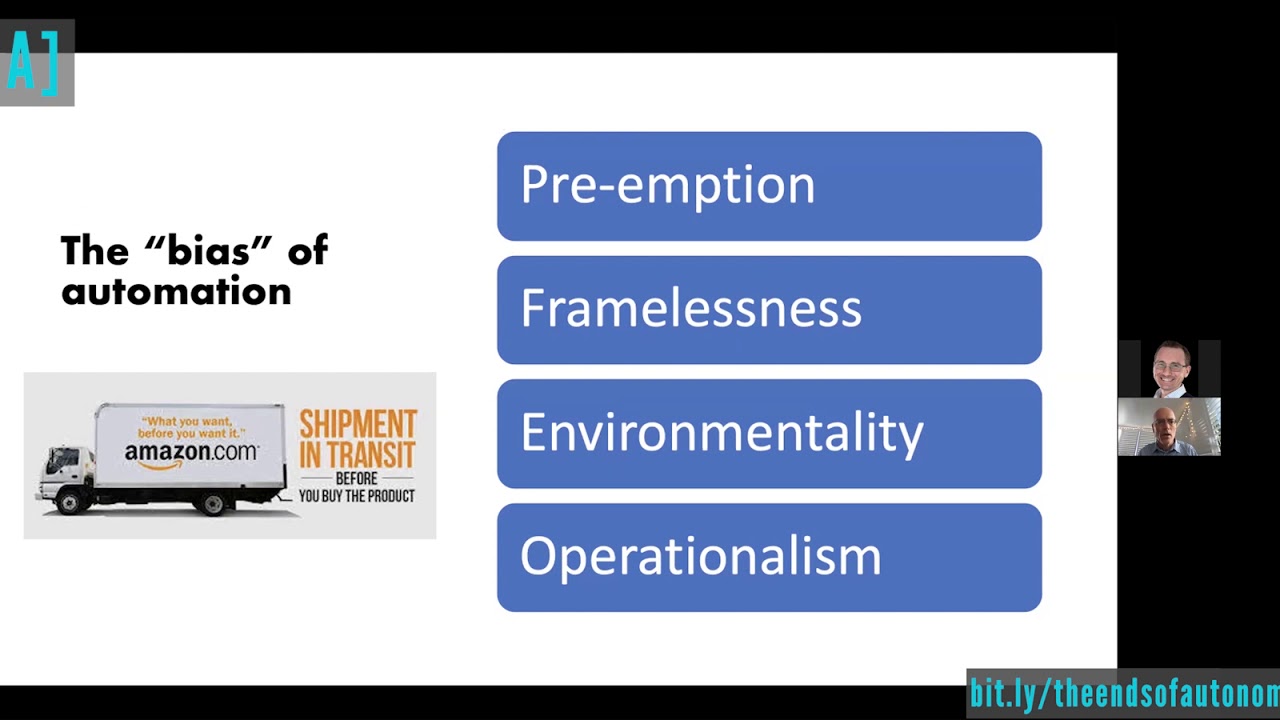

Mark Andrejevic, Automating Surveillance: Post-Representational and Post-Subjective Governance

2 Cara Instalasi Anaconda dan Pengenalan Google Colab

Aníbal Quijano en el III Congreso Latinoamericano y Caribeño de Ciencias Sociales

9 if else