Understanding Liquidity, Credit, and Crises in Global Financial Markets

A comprehensive discussion on liquidity, credit, and crises in global financial markets, with a focus on funding liquidity and the role of central banks.

00:00:00 Michael Howell discusses liquidity, credit, and crises in global financial markets, emphasizing the importance of funding liquidity and the role of central banks, particularly the Federal Reserve and the People's Bank of China.

🌐 Global liquidity is the flow of cash and credit through global financial markets.

💰 Funding liquidity is the ability to trade, facilitated by having the necessary resources and credit.

🏛️ Central banks, particularly the Federal Reserve and the People's Bank of China, play a significant role in funding liquidity.

📊 Liquidity in markets is measured by factors like bid/ask spreads and trade size.

🏦 Collateral, such as high-quality bonds, is important for securing credit and maintaining liquidity.

00:06:17 This video discusses the threat to the collateral pull in financial markets, caused by bond market volatility and credit downgrade. It explores the impact on liquidity and risk assets.

📚 The value of collateral affects credit contraction and liquidity in the market.

💰 Central banks are adding liquidity back to markets, but the risk lies in the pressure on collateral.

📉 Recent events, such as bond market fluctuations and credit downgrades, are impacting bond volatility and global liquidity.

00:12:36 The video discusses the potential interference of Western Powers in the Chinese economy, the pressure on the Chinese Yuan, and the attempt to address the US fiscal situation. It also covers the scarcity of high-quality collateral and the risk of a duration crisis leading to a credit crisis. The concept of the Yen carry trade and its impact on markets is explained.

👉 There may have been a deliberate attempt by Western Powers to derail the Chinese economy and pressure their financial system by weakening the Yen and Chinese Yuan.

👉 The US fiscal situation is worsening, and there may be a deal in place for China to continue buying US Treasuries to address rising treasury yields.

👉 There is a collateral shortage in the market due to limited supply of high-quality debt, which enhances the value of US Treasuries compared to German buns.

👉 There is a high probability that a duration crisis could lead to a credit crisis, resulting in decreased liquidity and potential market disturbances.

👉 The Yen carry trade involves borrowing in a weak currency like the Japanese Yen and investing in a stronger currency like the US dollar.

00:18:53 Liquidity, Credit, and Crises: A comprehensive discussion on the impact of the Japanese bond market on the global financial market, particularly the US treasury market, and the challenges China faces as it tries to reduce its dependency on the dollar.

📈 The repatriation of funds by Japanese insurance and pension funds from the treasury market to the JGB market is likely to have significant implications for global financial and international bond markets.

💰 The changing yield base of the Japanese bond market could have a major impact on the US treasury market, especially considering the skyrocketing interest bill on US debt.

💱 China's goal of reducing the dollar's dominance in their financial system and the US technology bans on China are affecting the Chinese economy and its real exchange rate, potentially leading to devaluation of the Yuan.

💵 While changes in trade denomination may increase the circulation of the Yuan, it is unlikely to displace the dollar in the international financial system.

00:25:01 The video discusses the role of the US financial system as the Banker of the world and its impact on the international financial system. It also touches on the relationship between oil prices and liquidity conditions. The outlook suggests a potential interruption in the bull market, but overall improvement in liquidity conditions.

The U.S. financial system acts as the banker of the world, allowing foreign countries to borrow in dollars and invest in U.S. financial markets.

The role of the dollar in the international financial system remains strong, despite the impact of a gold-backed Yuan.

The movement of oil and its effect on liquidity is a major factor in the global economy.

00:31:18 A comprehensive discussion on liquidity, credit, and market volatility. Seasonality affects liquidity, with higher volatility expected in the next six months. Uncertainty remains, but short-term treasuries and gold may be attractive investments.

📈 Liquidity tends to be lower during certain periods of the calendar year, leading to higher volatility.

🐻 There is a potential credit event and a risk of a market downturn, challenging the idea of being in a bull market.

💰 Short-dated treasuries in dollars are seen as a safe investment, while gold and cryptocurrency are potential options for hedging against uncertainty.

00:37:35 A comprehensive dialogue on liquidity, credit, and crises with Michael Howell. Discussions on gold, Bitcoin, euro dollar markets, Brazil's liquidity, and the performance of emerging markets.

📈 Gold and Bitcoin have potential for growth in a risk-off market.

💰 Emerging markets, including Brazil, have seen robust liquidity inflows.

💼 The financial sector needs to show strong performance for a market rally.

00:43:18 A comprehensive interview with Michael Howell discussing liquidity, credit, and crises. Check out the interview on YouTube.

📺 The video is an interview with Michael Howell.

💰 The interview discusses liquidity and credit.

🌍 The dialogue also covers crises.

You might also like...

Read more on People & Blogs

The Pandora Papers: How the world of offshore finance is still flourishing | Four Corners

SÚPER AYUDA #67 Resuelve El Problema Del Colon Irritable

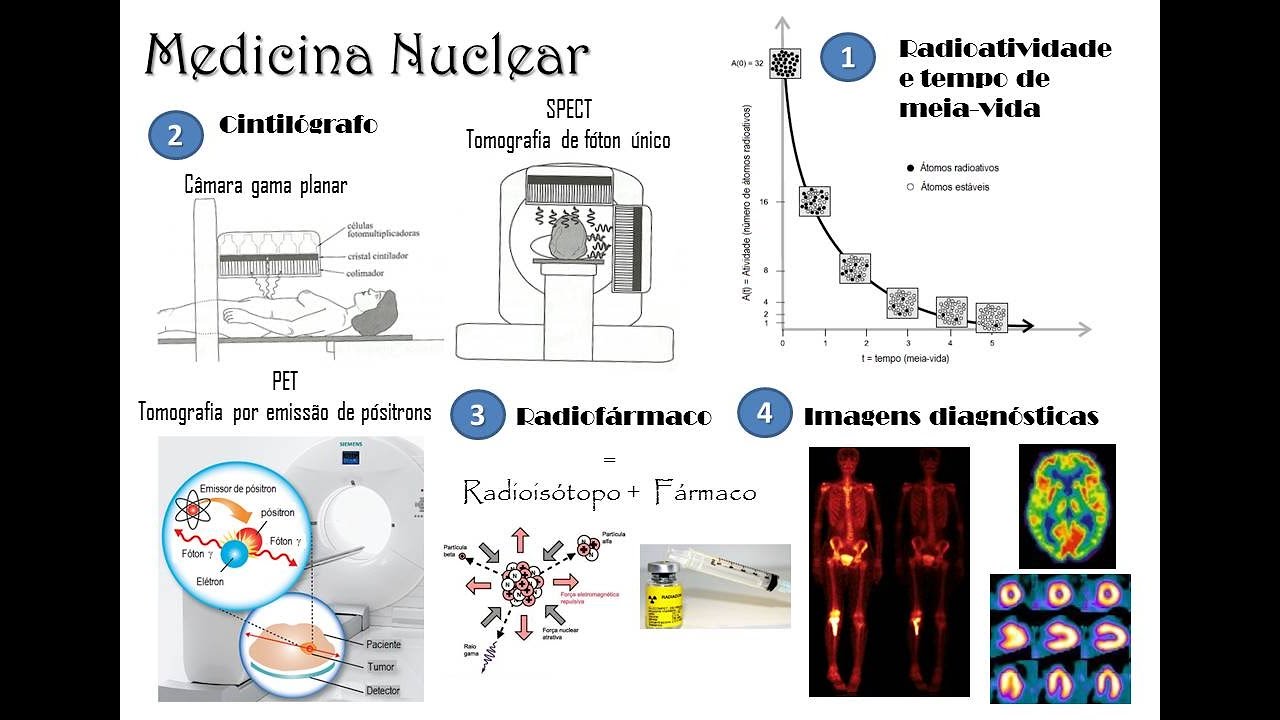

Medicina Nuclear - Tópicos Gerais

Why our generals were more successful in World War II than in Korea, Vietnam or Iraq/Afghanistan

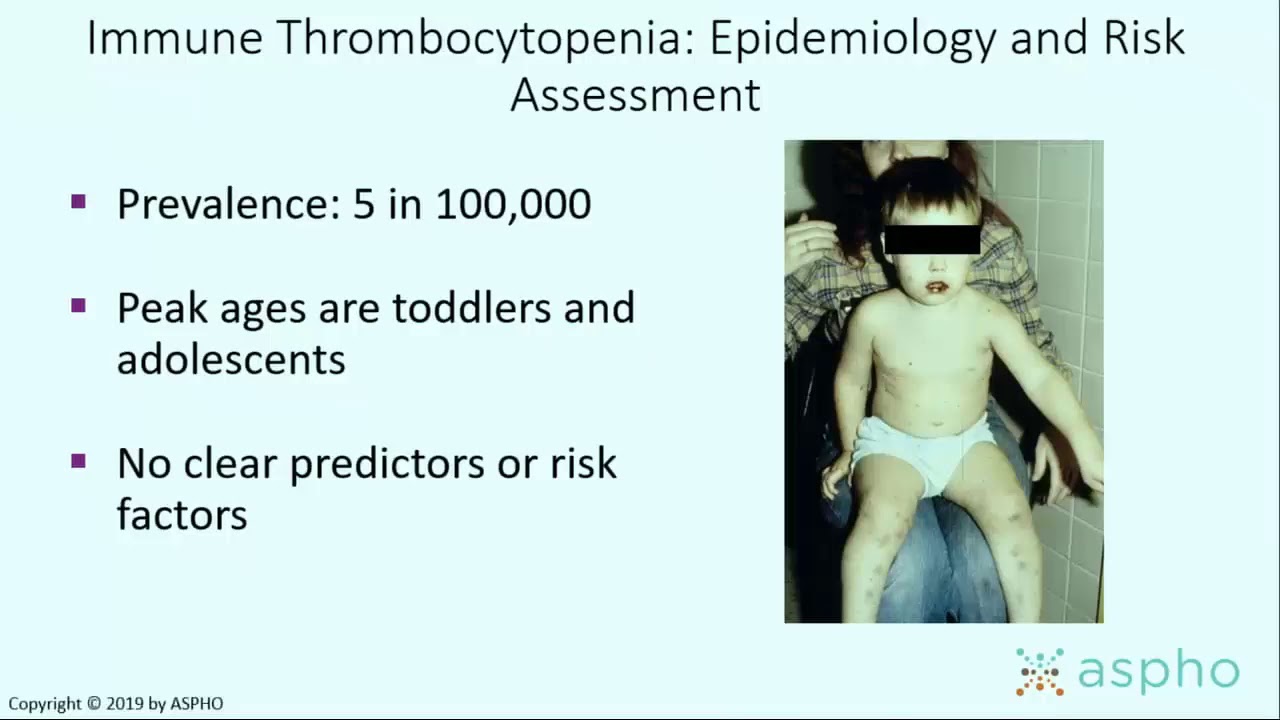

126 Disorders of Platelets

how to find your aesthetic as a guy