Unveiling the Untold Investment That Financial Planners Overlook

Explore the concept of guaranteed investments and question financial planners' ability to offer them. Discover the benefits of investing in U.S. government bonds.

00:00:49 The video discusses the concept of a guaranteed investment and questions whether financial planners can truly offer such investments. It challenges the notion of speculation and explores different ways to achieve a guaranteed return.

Many people are looking for a guaranteed investment that can provide a guaranteed return.

Certified financial planners may not be able to show you investments that are truly guaranteed to provide a return, as their training and perspective may limit their options.

Understanding speculation and differentiating it from safe investments is key to achieving the desired returns in the market.

00:12:42 The video discusses speculation in various market-based activities and challenges the notion of guaranteed investments. It examines mutual funds as a type of financial investment tied to the overall market, highlighting the lack of guaranteed returns.

Speculation is investing or trading with hope of gain and risk of loss.

Most market-based activities involve speculation.

Traditional investment options may not guarantee returns.

00:24:34 The video discusses the high returns and risks associated with index funds. It emphasizes the importance of understanding where your money is being invested and the potential consequences of market downturns.

📊 The returns of various investments such as Vanguard and index funds are discussed, with emphasis on the importance of understanding what one's money is being invested in.

💼 Relying solely on financial planners or professionals without understanding the market and investments is considered risky.

💰 Government bonds are presented as a guaranteed investment option, but with low returns over an extended period of time.

00:35:19 Learn why investing in U.S. government bonds, notes, and bills can provide a guaranteed return and minimize risk compared to other investment options.

💼 The speaker emphasizes the stability of investing in US government bonds, notes, and bills as a guaranteed way to avoid losing money.

📉 Investing in the stock market and other bank products carries the risk of losing money if the market declines.

💰 The speaker suggests that individuals should educate themselves about the market and make informed decisions about where to invest based on their risk analysis.

00:47:08 A discussion about the role of financial planners and the impact of interest rates on the economy. The speaker also highlights the potential risks and benefits of investing in government bonds of other countries.

✅ Financial planners may not provide all the necessary information regarding investment options.

🏦 The American economy relies on low interest rates and access to cheap credit to maintain consumer spending.

💰 Fintech firms and buy-now-pay-later companies may face challenges as interest rates increase.

00:59:00 The video discusses the potential impact of automation, universal basic income, and the role of central banks in the global economy. It also highlights the importance of understanding financial markets and the consequences of mismanaged resources in certain countries.

📈 The speaker discusses the potential risks and limitations of traditional investment options, such as the stock market, and how they can be manipulated by larger entities.

💰 The speaker highlights the importance of understanding credit markets and banking infrastructure for e-commerce and financial stability, both domestically and globally.

🌍 The speaker emphasizes the interconnectedness of global markets and the role of central banks in shaping financial systems, while also addressing the impact of bad leadership and debt on developing countries.

01:10:36 The speaker discusses the issue of poor leadership in African countries, leading to poverty and corruption. He also discusses the impact of external investments and the exploitation of resources. The video emphasizes the need for accountable leadership and development programs.

The issue of poverty in African countries is not just due to the IMF and World Bank, but also due to poor leadership.

Investing in African countries is seen as risky due to corruption, which discourages foreign investment.

The lack of development in Haiti is partly due to the exploitation of its resources by a small group of wealthy individuals.

01:22:26 Learn about a guaranteed investment that financial planners don't mention. It can change your life for the better. #financialplanners

💰 Financial planners may not always mention the guaranteed investment opportunity online that can change lives for the better.

📆 There is a limited time offer for a 15% discount on Black Friday.

👋 Have a good evening and talk to you later.

You might also like...

Read more on Entertainment![1- Chimie minérale I [Cristallographie ] Notions de Bases .](https://i.ytimg.com/vi/2WjUCz5JHPg/maxresdefault.jpg)

1- Chimie minérale I [Cristallographie ] Notions de Bases .

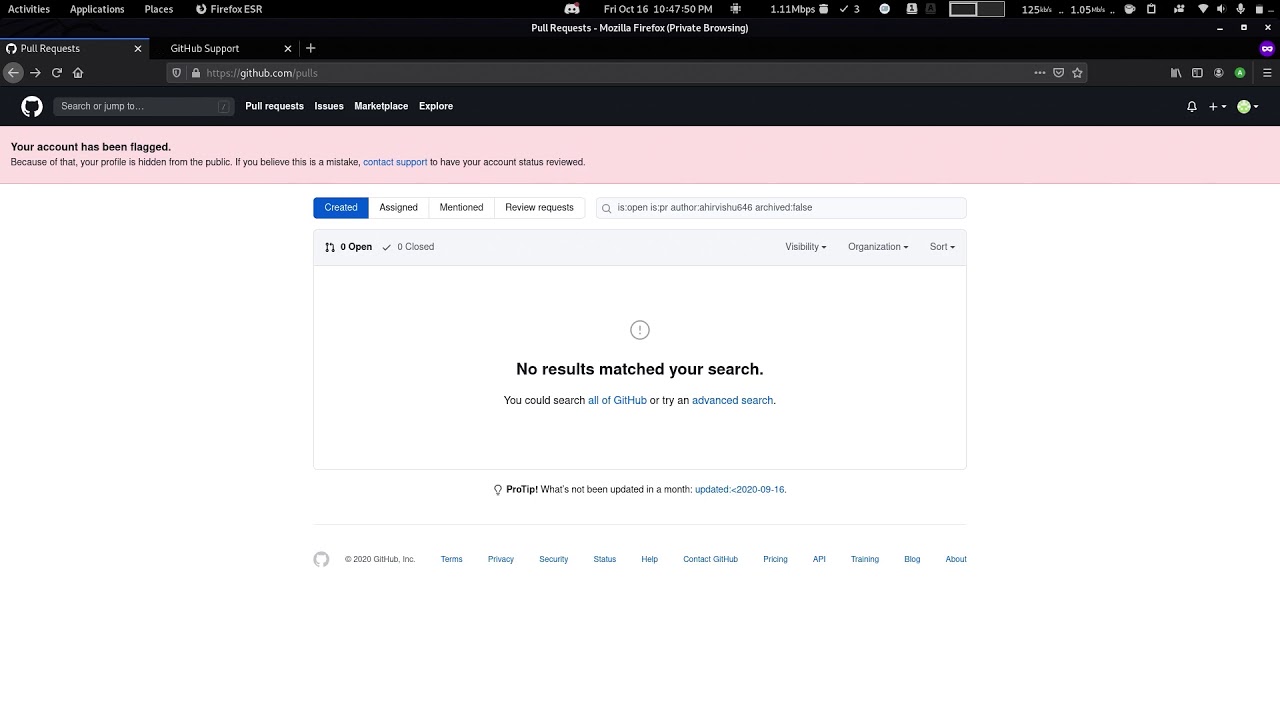

Github(hacktober) issue your account has been flagged

Client Speak: Anand Makwana, Senior Manager – Analytics and Strategy at Zebra Technologies

How Will Artificial Intelligence Affect Your Life | Jeff Dean | TEDxLA

Copywriting Success - Peter 2 | The Real World | Interview 286

Top Risk Factors Destroying Your Brain & How To Repair It For Longevity | Dr. Majid Fotuhi