The 6 Lessons that the Rich Teach Their Children

Learn the 6 lessons that the wealthy teach their children to escape the never-ending cycle of financial struggle and make money work for you.

00:00:00 [COMPLETO] PAI RICO PAI POBRE |As 6 Lições que os RICOS ensinam aos seus filhos| SejaUmaPessoaMelhor.

📘 The video is about the book 'Rich Dad Poor Dad' by Robert Kiyosaki and the lessons he learned from his two fathers.

💰 One of his fathers, referred to as 'Poor Dad,' had a stable job but struggled financially. The other father, referred to as 'Rich Dad,' became incredibly wealthy and advised on entrepreneurship.

📚 The video discusses six lessons taught by Rich Dad over 30 years, emphasizing the importance of financial education and owning one's own business.

00:01:29 Learn the 6 lessons that the wealthy teach their children to escape the never-ending cycle of financial struggle and make money work for you.

💰 The video discusses the financial difficulties faced by the speaker's family and the solution of working more to solve the problem, but it led to a cycle of constantly needing more money.

🏃♂️ The majority of people are stuck in an endless cycle of working harder but not getting ahead, similar to a rat race.

🔑 The key to escaping this cycle is for the rich to make money work for them by constantly looking for opportunities to generate income through assets.

00:02:59 Learn the 6 lessons that the rich teach their children, including the importance of financial education and the difference between assets and liabilities.

📚 Having a mindset focused on possibilities and education is crucial in achieving financial success.

💰 There are two ways to generate income: earning through work and investing in assets that generate passive income.

💸 Expenses can be categorized as either essential (food, healthcare, education) or non-essential (luxury items), and it is important to understand the distinction in managing finances.

00:04:30 Learn the key lessons that rich people teach their children about wealth accumulation and asset management. Avoid being trapped in the cycle of working for others and start focusing on generating passive income.

📚 There are clear differences between the lower, middle, and upper classes in terms of assets and income.

💼 The lower class struggles with low income and lack of assets, while the middle class often mistakes liabilities for assets, leading to perpetual financial strain.

💰 The rich prioritize investing in assets that generate cash flow, such as businesses, stocks, real estate, and government bonds.

00:06:00 Learn the 6 lessons that rich parents teach their children, while the poor and middle class focus on liabilities instead of assets.

💰 The wealthy use their money to buy luxuries, while the poor and middle class focus on liabilities and struggle financially.

🏦 Contrary to popular belief, the poor often end up paying more in taxes than the rich, as the rich find ways to protect their assets.

📈 Wealthy individuals take advantage of loopholes such as untaxed dividends and buying/selling properties to reduce tax burdens.

00:07:31 In this video, the speaker discusses the six lessons that wealthy individuals teach their children. It emphasizes the importance of playing by the rules and having a trained mind to generate wealth.

The video discusses the importance of playing by the rules and thinking outside the box to create opportunities for wealth.

It emphasizes the power of a well-trained mind in creating unprecedented wealth.

The video challenges the traditional concept of working for money and encourages alternative ways of generating income.

00:09:01 A concise summary of the YouTube video: The 6 Lessons that the Rich Teach Their Children

💼 Powerful individuals and companies groom promising young graduates for high-ranking positions by providing them with opportunities to learn and gain experience in different departments.

🎯 The recommendation from 'Pai Rico' is to focus on opportunities for learning rather than just monetary gain.

📚 The book 'Pai Rico Pai Pobre' highlights six important lessons: financial education, the importance of industry knowledge, choosing mentors wisely, taking calculated risks, staying updated on market trends, and working to learn, not just for money.

You might also like...

Read more on Education

Webinar: Microsoft Copilot & OpenAI in Health & Life Sciences - 8/2/2023

Common Pitch Chile Fernando Nilo Recycla Participa con #googlecommon en Google+

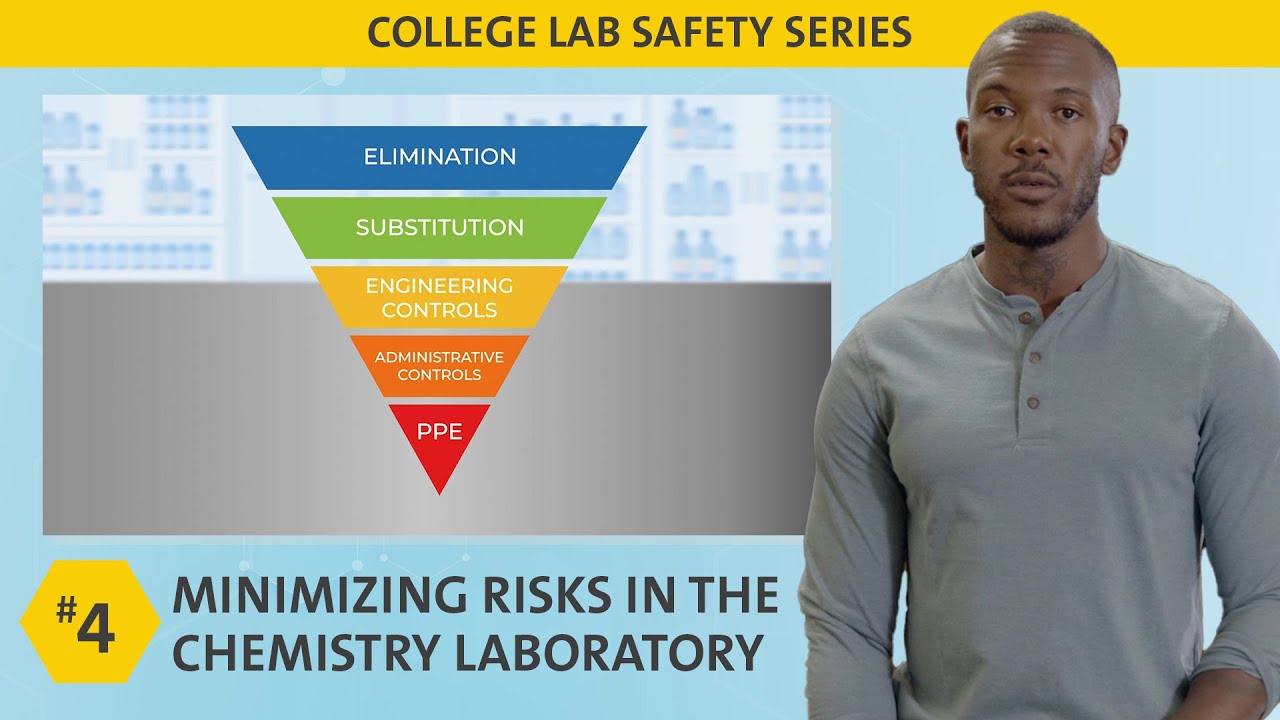

Minimizing Risks in the Chemistry Laboratory | ACS College Safety Video #4

Cebuano 101 With My Mom

¿Deberíamos comer insectos? - Emma Bryce

How to Create VIRAL Relaxing Videos in 1 Minute for MILLIONS of Views